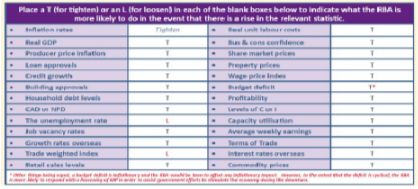

a) Growth in the rate of real GDP to unsustainable levels is most likely to cause the RBA to make monetary policy less expansionary or more restrictive via a tightening of policy and an increase in the target cash rate.

b) Higher producer prices (e.g. the prices for raw materials or equipment) will create cost inflationary pressures and therefore result in the RBA more likely to tighten monetary policy in order to reduce ‘inflationary’ pressures in the economy. [The extent to which the RBA tightens policy in the face of cost inflationary pressures will ultimately depend on the underlying strength of the economy.]

c) Falling asset prices ikely to reduce consumer demand (via the wealth effect) and contribute to a reduction in demand inflationary pressures. Other things being equal, the RBA is more likely to loosen monetary policy given that inflation becomes less of a concern and the RBA will be freer to focus on growth and jobs.

d) A smaller structural budget deficit implies that the government is adopting a less expansionary or more contractionary budgetary policy stance. This should help to reduce inflationary pressures in the economy and therefore enable the RBA to implement a more expansionary monetary policy setting than would otherwise be the case.

e) A tighter labour market is reflected by strong growth in the demand for labour relative to the supply of labour. This should help to reduce the rate of unemployment as businesses take on mare workers and, at the same time, result in an increase in job vacancy rates as firms will find it increasingly difficult to fill positions at workplaces. As a consequence of the relatively strong demand for labour, wages growth is likely to increase which exerts upward pressure on real unit labour costs and therefore inflation.

f) Lower capacity utilisation rates means that there is more spare capacity in the economy, which exerts downward pressure on prices and inflation. The RBA is therefore more likely to switch its attention away from inflation and towards economic growth and jobs via the implementation of a more expansionary or less restrictive monetary policy setting.

g) A lower TWI effectively means that the exchange rate appreciates, which increases inflation (on both the demand and supply sides) and therefore makes it more likely that the RBA will adopt a less expansionary or more restrictive monetary policy setting by tightening policy and Lherefore increasing the Largel cash rate.

h) Slower growth in China is likely to negatively impact on the rate of growth in Australia, which exerts downward pressure on prices and inflation and therefore makes it more likely that the RBA will adopt a more expansionary or less restrictive monetary policy setting by loosening policy and decreasing the target cash rate.